April was largely a sales disaster for most of the nation's largest retail chain stores.

But it wasn't unexpected. Retailers raised flags well ahead of Thursday's results and investors grounded themselves long before that for what undoubtedly would be the weakest month, so far, of the year.

According to the article, Wal-Mart sales dropped 3.5%, American Eagle Outfitters dropped 10%, Pacific Sunwear dropped 16.5%, Bebe dropped 6.5%, and Chico's dropped 7.3%.

Bloomberg reported the primary reasons retailers gave for the drop.

Easter fell eight days earlier than in 2006, shifting most holiday purchases into March, when more than two-thirds of retailers beat estimates. The coldest April in a decade and more than average amounts of rain and snow crimped sales of shorts, dresses and other spring clothing.

``Easter took some sales from April into March,'' Steven Baumgarten, an analyst at PNC Wealth Management in Philadelphia, said May 8. ``You aren't thinking about buying the new bathing suit when there's an ice storm outside.'' The firm manages $54 billion, including shares of Wal-Mart and J.C. Penney Co.

....

Last month was the coldest April since 1997 in the U.S., the wettest in four years and the snowiest in more than 14 years, according to Weather Trends International, a Bethlehem, Pennsylvania-based firm. The Northeast and North Central states were especially hit by snow, the firm said.

Retail spending may have also been hampered by higher gasoline prices. The average price of a gallon of unleaded gasoline rose to $3.05 for the week ended May 7, the highest since September 2005, the U.S. Energy Department said.

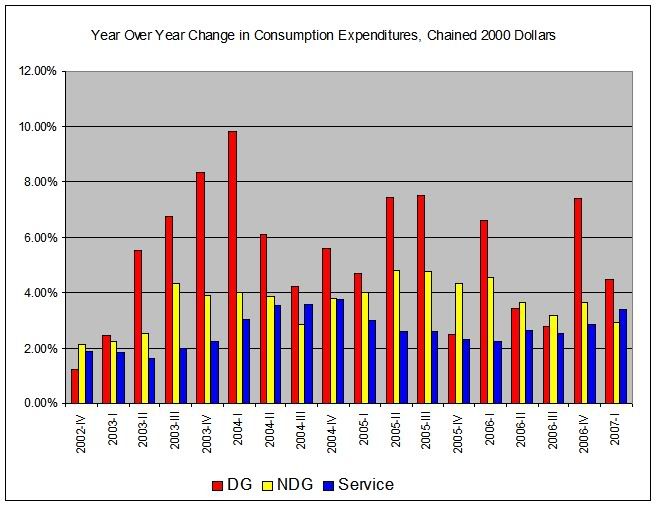

Here is a chart of the year-over-year change in personal consumption expenditures in 2000 chained dollars. This chart will provide some context. DG = durable goods, NDG = non-durable goods and services = services. Notice the continued strength of the year-over-year comparison.

So, the US consumer has continued to shop for a variety of reasons, regardless of a host of limiting factors.

Now, this month's drop is attributed to the following:

1.) Easter occurring 8 days earlier this year. If we were seeing smaller drops this explanation would make sense. However, when the world's largest retailer's sales drops 3.5% in a month, that signals something a bit deeper.

2.) The weather. Again, a small drop makes this story plausible. But Americans have demonstrated a desire to continually shop regardless of the weather, income or overall condition of the economy. The consumer's history indicates this explanation is lacking.

3.) Gas prices. I think this is a bigger reason than people think. People see gas prices every day and have to pay them at least once a week if not more. In other words, consumers experience this personally every week. Gas prices are at/near records right now and it's the beginning of the summer driving season.

One analyst above stated April was the "perfect storm". This explanation makes sense to a certain extent. All three above-listed factors happening at the same time provide a viable explanation.

The coming months numbers are now extremely important. Now that the US consumer has pulled back for a month, we'll see how he feels about not spending so much.