The Fed's move put more pressure on the dollar because it made returns on investment in other countries more valuable. The weak dollar also means that American goods are cheaper for overseas buyers, which can help manufacturing and producers, and can help companies with big foreign operations turn a larger profit by converting overseas profit into dollars.

But it also could scare away foreign investors who help to finance the U.S.'s debt. As investment in U.S. Treasury securities dwindles, the government will have to pay higher rates at weekly auctions to find buyers for its bills, notes and bonds. That eventually could push up borrowing costs for all Americans.

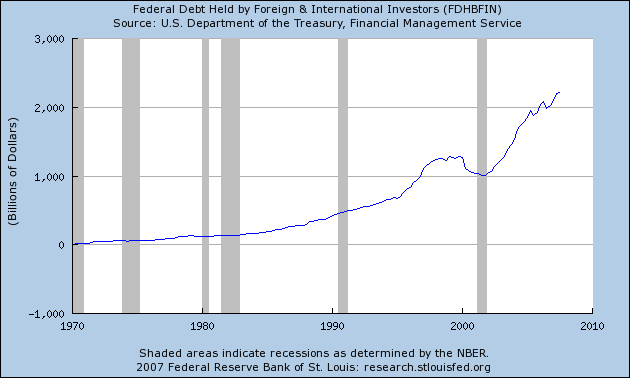

Here is a chart from the St. Louis Federal Reserve that shows how dependent the US economy is on foreigners purchasing US government debt:

My guess is this will add further long-term upward pressure on interest rates.