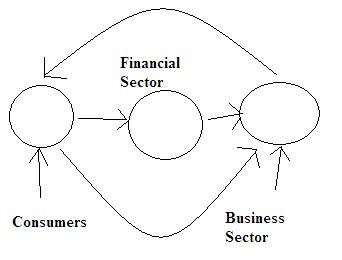

The above picture is a poorly drawn and simplified diagram of an economy. This is from my old economics textbook written my Paul Samuelson. Basically, business pays wages to consumers who then purchase products from business. That's the outer circle of the system. But financial companies stand in the middle of the economy and act as intermediaries between consumers and business. In the simplified version, consumers either make deposits at financial companies, provide money in the form of investment capital (buying and selling securities) or take out loans that are then repackaged and sold to other financial companies or businesses.

In essence, financial companies are as "intermediaries" between consumers and business. They are a conduit that pools resources from a large number of individuals and then redistributes the money to business in the form of loans or securities.

That is why these companies are so important. When they aren't working properly, the economy either slows or grinds to a halt.

Here are charts from Prophet.net of all the regional and money center banks. Notice that with the exception of NE banks, the entire sector is in a literal freefall right now.