European inflation accelerated more than initially estimated in March, reinforcing the European Central Bank's resistance to cutting interest rates even as economic growth cools.

The inflation rate rose to 3.6 percent last month, the highest in almost 16 years, the European Union's statistics office in Luxembourg said today. The March figure is up from 3.3 percent in February and exceeds an estimate of 3.5 percent published on March 31.

Food and energy prices stoked inflation in March, and the euro extended its gains after the report, rising to a record against the dollar. ECB Executive Board member Juergen Stark yesterday said interest rates may not be high enough to contain inflation, while Greek colleague Nicholas Garganas said price pressure ``is more intense than previously foreseen.''

``Concerns about upside risks to the inflation outlook are unlikely to ease quickly, leaving little, if any, scope for the ECB soften its interest-rate stance,'' said Martin van Vliet, an economist at ING Group in Amsterdam. ``This may help push the euro-dollar to $1.60 in the short term.''

....

Food-price inflation accelerated to 6.2 percent in March from 5.8 percent in February, the highest since Eurostat began the current series in 1997. Rice climbed to a record $22.67 per 100 pounds today on rising demand and as floods delayed planting in the U.S. Wheat, corn and soybeans also have risen to records.

Energy-price inflation accelerated to 11.2 percent from 10.4 percent, the highest since May 2006. Crude oil has risen 79 percent in the last 12 months and reached a record above $114 a barrel yesterday.

First, notice that at least we're not the only country that is dealing with spiking inflation.

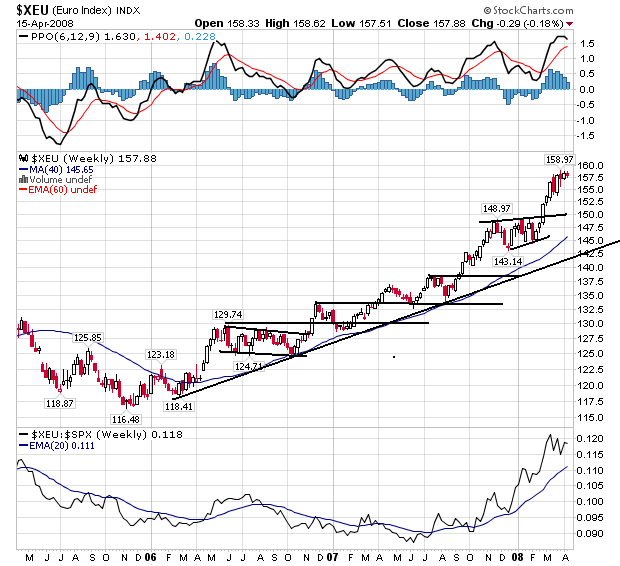

Secondly, notice the European Response -- not raising rates. The reason is the European Central Bank (ECB) is less concerned with preventing a recession. Instead, they view their mandate as inflation fighters or as promoters of price stability as extremely important. As a result, the euro is rallying:

On the chart, notice the following:

-- Prices have been rallying since 2006

-- Prices have continually moved through previous levels of resistance to hit new levels.

-- After hitting new levels prices consolidate, shaking out some players who take profits and inviting new players in to take new positions.

From Bloomberg:

Rice climbed to a record for a second day as the Philippines, the world's biggest importer, sought 1 million metric tons and floods delayed planting in the U.S., increasing concern of a global shortage.

The Philippines will hold a tender tomorrow for 500,000 tons of rice, with another to follow on May 5. A March tender filled just 61 percent of requirements at prices double those six months earlier. Last year, the country imported 1.9 million tons of rice, equivalent to about 15 percent of annual needs. Food lines have formed as people wait for rice.

Rice in Chicago surged 2.3 percent today to $22.67 per 100 pounds on rising demand and export curbs from some producing nations, stoking global concern about inflation and the potential for social unrest. Rice, the staple food for half the world, has more than doubled in a year. Wheat has gained 93 percent in that time, while corn is up 61 percent.

``We've seen an unprecedented bull run in rice prices,'' Luke Chandler, senior commodities analyst at Rabobank Group, said in an interview today with Bloomberg Television. ``It's almost becoming like a supply shock because the countries that rely on the imports aren't able to access the available sources.''

Here's a chart:

Notice the extreme price spike in rice's price. This is an unsustainable move up in the long run -- meaning prices are really over-extended. But the problem is there is panic buying going on which will really spike prices hard in the short run. As a result, don't be surprised to see rice continue to move higher.

But it's not just rice:

U.S. rice, corn and crude futures soared to record highs Tuesday on supply concerns, in turn boosting gold on inflation worries.

On the New York Mercantile Exchange, the front-month crude settled up $2.03, or 1.82%, at $113.79 on a combination of supply issues, rising diesel demand in China and persistent dollar weakness. Crude futures later rose to a record high of $114.08 after settlement.

Rice and corn futures rocketed to all-time highs on tight world grain supplies and planting delays, with the rally in crude providing an additional boost to grains.

Chicago Board of Trade rice prices have doubled since last September, with Asian prices soaring even more sharply since January as big importers have rushed to build stocks on fears that supplies will become scarce as exporters clamp down on shipments.

Here is a chart of corn:

Notice prices are in a solid uptrend; they have moved through previously established resistance to establish new highs and then have sold-off to previously established upward sloping trend lines. This is a bullish chart.

Notice that oil has the same pattern as corn; prices have continued to rise, consolidate gains and then continue to move higher. Oil has a clear support level as well.