For the second time in two years, Oil's choke hold on the economy is asserting itself. Acceleration in recovery causes acceleration of demand, and acceleration of Oil prices - which causes the economy to stall. That choke hold won't go on forever, though. There are three forces that will combine to bring it to an end: alternate fuels, conservation, and exploration.

1. Alternate fuels and technology

Perhaps the most promising alternate fuel to oil is natural gas. According to the EIA, natural gas reserves increased 11.3% in 2010. Nautral gas exploration in the northeeastern US, Texas, and North Dakota is proceeding robustly, and we can expect natural gas usage to increase over the next decade.

In addition to natural gas, alternate technology in the form of hybrid vehicles is finally making up a small but significant share of vehicle sales. In 2010, hybrid vehicles made up ~2.5% of all vehicles sold. As gasoline prices have continued to increase, in the first three months of 2011:

2. Conservation

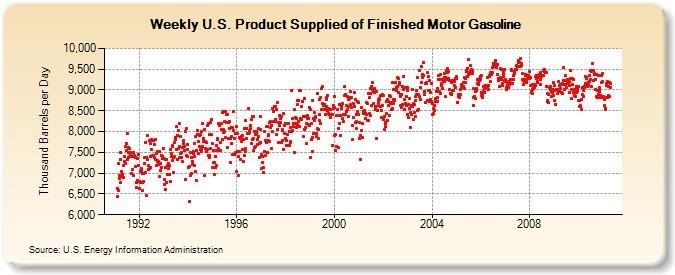

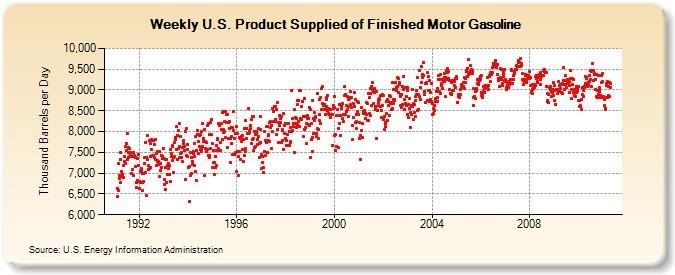

The fact is that the 2008 Oil spike and the "great recession" have left a substantial dent in US Oil consumption, as shown in this graph of weekly usage:

Continuing high gas prices are once again having an impact an auto buying. While April as a whole logged in at 13.1 M vehicles sold on an annualized basis, the Detroit News reported that:

Over the short term, demand for fuel is inelastic, but over the longer term we can see that people do adopt strategies to conserve energy usage in the face of high prices. As in 2008, high gas prices are causing an increase in the use of mass transit. For example, in the Miami, FL area mass transit usage is up 11% compared with last year. Other areas, such as Philadelphia, have shown similar increases.

3. Exploration

In addition to opening up natural gas exploration, $100 Oil is causing renewed drilling for Oil in areas where it was previously unprofitable. As a result, US Oil production has actually increased in the last two years:

Additionally, deep water drilling in places like offshore Brazil, have led to discoveries such as this one noted in 2009:

As the Wall Street Journal reported in 2009:

In Summary, however, the Oil choke hold on the economy will not last forever. I claim no clairvoyange, but a good guess is that by 2013 or 2014, the combination of alternative fuels and technology, conservation, and exploration will relieve the current situation.

Growth in highly fuel-efficient vehicles far outpaced the rest of the market.Although this probably only means an increase to 2.7% of all vehicles so far, looking further out into the future, the recently released J.D. Power and Associates 2011 US Green Automotive Study

In the first quarter of 2011, hybrids increased sales by 33.9 percent, while the overall market grew by 20.2 percent. In March, small cars— such as the Ford Fiesta and Honda Fit—grew at almost twice the rate of the overall market, 30 percent compared to 17 percent.

...

Hybrids and small cars are even bigger in the used car market.

indicates major growth in consumer interest in green cars—including hybrids, clean diesel, plug-in hybrids and pure electric cars. The market research firm expects as much as 10 percent of sales to come from vehicles with these fuel-efficient technologies by 2016. That would represent a four-fold increase in the sales numbers for green carsIf $4 gasoliine becomes the norm, I suspect that estimate may be substantially to the low side.

2. Conservation

The fact is that the 2008 Oil spike and the "great recession" have left a substantial dent in US Oil consumption, as shown in this graph of weekly usage:

Continuing high gas prices are once again having an impact an auto buying. While April as a whole logged in at 13.1 M vehicles sold on an annualized basis, the Detroit News reported that:

April started strong, but took a dive as gas prices spiked, storms ravaged the Midwest and South, and parts supply shortages in earthquake-stricken Japan squeezed new car and truck inventories, analysts say.Furthermore, as I noted above, there has been a marked shift not just to hybrid vehicles, but also to smaller, more fuel efficient models.

Over the short term, demand for fuel is inelastic, but over the longer term we can see that people do adopt strategies to conserve energy usage in the face of high prices. As in 2008, high gas prices are causing an increase in the use of mass transit. For example, in the Miami, FL area mass transit usage is up 11% compared with last year. Other areas, such as Philadelphia, have shown similar increases.

3. Exploration

In addition to opening up natural gas exploration, $100 Oil is causing renewed drilling for Oil in areas where it was previously unprofitable. As a result, US Oil production has actually increased in the last two years:

Additionally, deep water drilling in places like offshore Brazil, have led to discoveries such as this one noted in 2009:

Brasileiro SA, Brazil's state-controlled oil company, says its tests show the Guara deepwater offshore field holds between 1.1 billion and 2 billion barrels of oil and initial production may start in 2012 with 50,000 barrels of oil equivalent a day.This deposit, known as the Guara field, is scheduled

to start pilot production in early 2013 at a rate of 120,000 barrels a day of oil and 5 million cubic meters a day of natural gas,, according to Petrobras.

As the Wall Street Journal reported in 2009:

When this is added to the Tupi and Lara fields recently found by the Brazilian oil giant Petrobras, the total yield could be close to 12 billion barrels. It has been years since deposits of this size have been found anywhere.The same article in 2009 reported on another huge find that has since taken on another significance:

BP (BP) last week said it found an oil field deep under the Gulf of Mexico that could yield as much as one billion barrels of oil and gas.Yes, I think we know about that last "gusher."

In Summary, however, the Oil choke hold on the economy will not last forever. I claim no clairvoyange, but a good guess is that by 2013 or 2014, the combination of alternative fuels and technology, conservation, and exploration will relieve the current situation.